We drive Innovation

We combine innovation and physical logistics

Increasing volumes, ever faster throughput times and high demands on process reliability? We meet the growing challenges in logistics with innovative automation, software and robot technologies. Always with a focus on our clients. We don't use our solutions to have a showcase in our portfolio - they have to offer real added value and measurably increase efficiency.

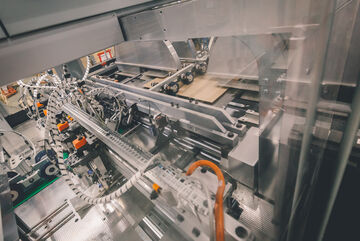

Automation for maximum efficiency

Our goal: to provide you the best possible solution for your requirements. To do this, we automate complex processes using standardized modules and innovative technologies. The result: a precise fit and high efficiency. Through automation, we ensure scalability for your business and help you grow.

SPEED AND FLEXIBILITY ARE ESSENTIAL FOR OUR CLIENTS. OUR GOAL IS TO HELP OUR CLIENTS INCREASE THEIR PRODUCTIVITY THROUGH AUTOMATION AND TO RESPOND QUICKLY TO THEIR CHANGING REQUIREMENTS. WE ARE CONSTANTLY EVALUATING THE LATEST TECHNOLOGIES THAT WILL PROVIDE THE MOST VALUE FOR OUR CLIENTS AND IMPROVE THEIR OPERATIONS.

Philipp Rücker Head of Logistics Engineering & Transport Management

A selection of our solutions

Integrating automation is a constant process to increase our performance and to reduce the physical strain on employees. Be it inbound or outbound or in other warehouse areas. We are already successfully using the following innovative technologies: